For Anyone Looking To Save Money on Auto Insurance

Save Big On FLORIDA AUTO INSURANCE — Without Calling 30 Separate Providers!

While also ensuring you find the best coverage for your needs, saving you time with quick and easy quotes.

Location

Florida

Experience

Over 30+ Years

Over 30+

Promotion

Free Insurance Quote

Services

At AAAble Insurance Agency, we offer a comprehensive range of services designed to meet your needs:

Auto Insurance

Commercial Vehicle Insurance

Tag & Title Registration

We know that time isn’t always on your side. That’s why we assist with necessary registrations and renewals, simplifying the process so you can focus on what matters most.

Property Insurance

Reviews

About AAAble Insurance Agency

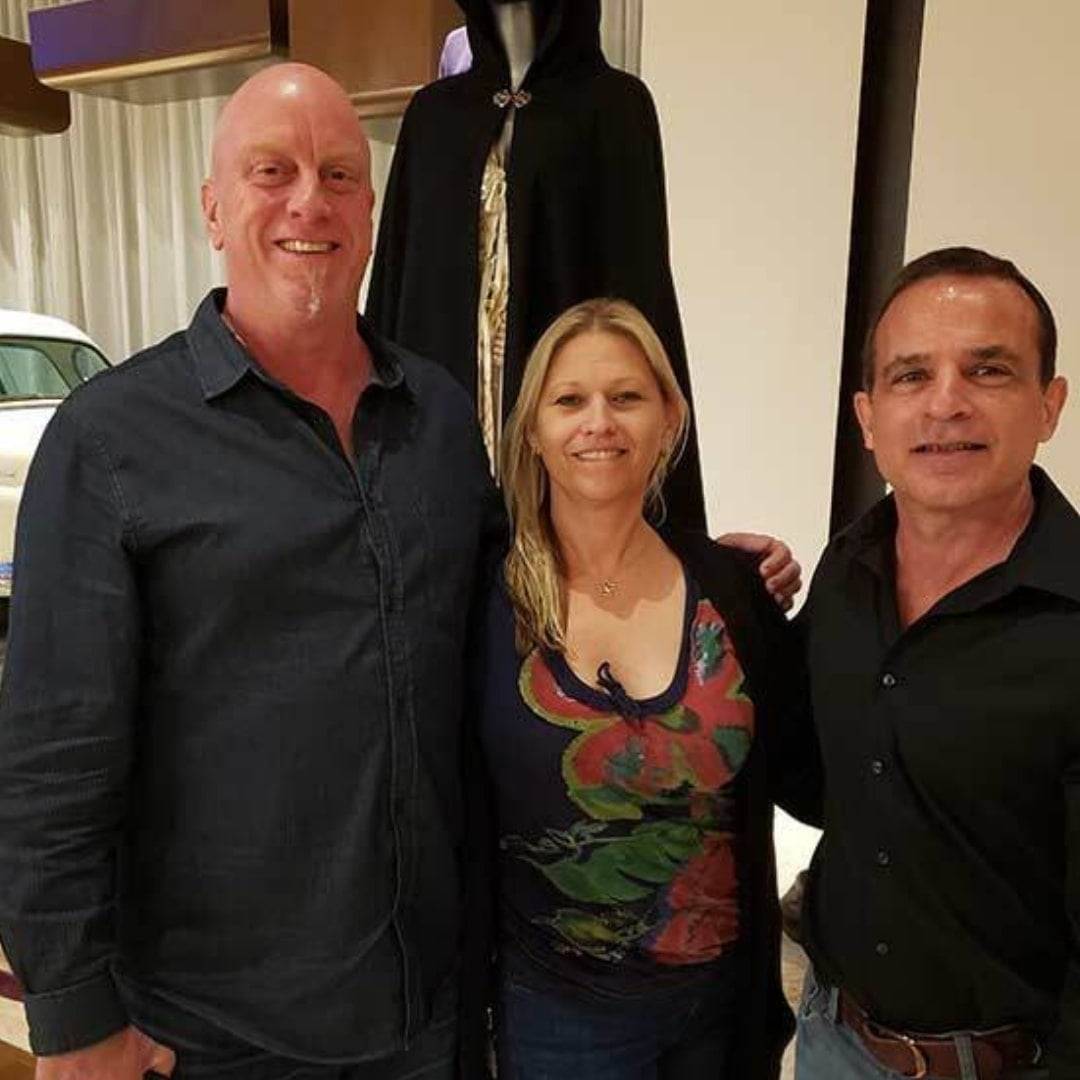

Welcome to AAAble Insurance, where we are committed to providing quality insurance solutions tailored to your needs. Founded nearly 30 years ago by my father, Dennis Lott, our agency has grown to become a trusted name in Broward County. Inspired by his success, I joined the team right after college, gaining experience as a courier, underwriter, and sales manager. Today, I am proud to continue his legacy of helping people and building lasting relationships with our clients, many of whom have become our best friends.

At AAAble Insurance, we understand that navigating the complex world of insurance can be overwhelming. That’s why we strive to simplify the process for you, ensuring that you receive the coverage you need without the added stress.

What sets us apart is our commitment to integrity and personalized service. Over the years, our team has developed trusted partnerships with over 30 insurance providers, allowing us to review and compare quotes to deliver the most affordable options available. If your rates increase at renewal time, we go the extra mile to shop around tirelessly for a better price.

We look forward to helping you secure peace of mind with comprehensive coverage that meets your unique needs. Let us be your partner in navigating the world of insurance, so you can focus on what truly matters.

Frequently Asked Questions

I have an older car, do I still need to purchase automobile insurance?

Many states require drivers to have car insurance. This law was created so that victims of accidents can receive the financial compensation they deserve if another individual is negligent and causes damages such as injuries, property damage, or death.

There are plenty of ways to reduce the cost of insurance on your old car, and you have a responsibility as an owner to know what each coverage does for your vehicle. The most important thing is to understand what coverage will protect you in case something happens—such as collision or theft protection—while knowing that there may be legal requirements if the lender requires certain insurance types.

What factors can affect the cost of my automobile insurance?

Insurance rates depend on a variety of factors, some that you have control over and others that are beyond your reach.

Factors such as the type of automobile you drive, where you live in relation to the company’s location or office can all play a role in how much it costs for insurance coverage. The cost also depends on your driving record or whether more drivers use one vehicle. Insurance providers often take into account accidents involving prior policies held by other policyholders who share an address – so having stricter rules at home could translate into lower premiums for everyone living there.

What does homeowners insurance cover?

I use my personal vehicle for my business. Can I insure it with a commercial insurance policy?

How To Start

Call or Complete the Form

Start Your Free Quote

We’ll provide you with a free quote tailored to your specific insurance requirements. Our knowledgeable agents will assess your situation and discuss the best coverage options available to you.

Save More Money

Ready to Save Money on Auto Insurance?

(takes about 30 seconds)

Get a Free Insurance Quote and discover how much you can save today! Call us at (954) 676-8474 or get started online!